estate tax changes over time

When debating changes in estate tax laws. The tax reform law doubled the BEA for tax-years 2018 through 2025.

Estate Tax Exemption 2021 Amount Goes Up Union Bank

You may recall that the 2017 Republican tax reform legislation roughly doubled the estate and gift tax exemption.

. It took a big jump because of the new tax plan that President Trump signed in December 2017. By 1940 the need for the US. This means starting in 2019 people are permitted to pass on tax-free 114 million from their estate and gifts they give before their death.

How did the tax reform law change gift and estate taxes. An estate tax is imposed on the net value of an individuals taxable estate after any exclusions or credits at the time of death. By 1864 the mounting cost of the Civil War led to the reenactment of the 1862 Act with some modi-.

The estate tax is imposed only on the part of the gross non-resident aliens estate that at the time of death is situated in the United States. The concern over the estate and gift taxes is that the federal exemption level. The Tax Cuts and Jobs Act doubled the gift and estate tax basic exclusion amount to 1118 million in 2018 indexed annually for inflation.

In 2022 the federal estate tax. The Estate Tax Exemption. People with incomes of 500 faced a 23 tax and the rates climbed up to 94.

That is only four years away and Congress could still. For tax year 2017 the estate tax exemption was 549 million for an individual or. The Tax Cuts and Jobs Act of 2017 TCJA doubled the estate tax exemption to 1118 million in 2018 indexed for inflation after 2018 but kept the 40 percent top rate.

The estate tax exemption is adjusted for inflation every year. Because the BEA is adjusted annually for inflation the 2018 BEA is 1118 million the 2019 BEA is 114 million and for 2020 the BEA is 1158 million. About 4100 estate tax returns will be filed for people who die in 2020 of which only about 1900 will be taxableless than 01 percent of the 28 million people expected to die in that year.

For large estates that are well above the 1158 million exclusion the case for acting now is much clearer than for. Fraction thereof over 150000. As Chart 3 shows in 1916 only estates over 1 billion in todays wealth would have been taxed at the top rate of 10 percent.

The exclusion is 1158 million in 2020. The estate tax sometimes also called the death tax is a tax thats levied on the transfer of a deceased persons assets. The proposed regulations are complex and may change the anticipated results of several other estate planning strategies.

The top tax rate for these years is 40. Because of a series of increases in the estate tax exemption few estates pay the tax. However the law did not make these changes permanent and the estate tax returned in 2011.

The American Taxpayer Relief Act of 2012 ATRA permanently extended the 2012 rules though with a new top rate of 40 percent. The federal estate tax exemption for 2022 is 1206 million. When the Tax Cuts and Jobs Act of 2017 was passed the federal estate tax exemption doubled from 5 million to 10 million adjusted for inflation until January 1 2026 when it ends.

What a rollback in the estate tax may do is impact those taxpayers who are considering whether to up the 1158 million exclusion before the end of the year because any changes in 2021 may be retroactive to January 1 2020. By the time he sold the home in 2010 it was worth 200000 less. The Fight Over Taxing Inherited Wealth Princeton University Press February 2005 hardcover 372.

From Fisher Investments 40 years managing money and helping thousands of families. The size of the estate tax exemption meant that a mere 01 of. When the Tax Cuts and Jobs Act of 2017 was passed the federal estate tax exemption doubled from 5 million to 10 million adjusted for inflation until January 1 2026 when it ends.

The proposed regulations are complex and may change the anticipated results of several other estate planning strategies. Under the tax reform law the increase is only temporary. In addition to using estate tax data directly for tax policy administration these data have formed.

Couples can pass on twice that amount or 228 million. After 2025 the exclusion is scheduled to revert to its level prior to 2018 and be cut by about one-half. To prepare for war and support its allies led to even more aggressive taxation.

Since 2013 the IRS estate tax exemption indexes for inflation. When President Barack Obama took office in 2009 the exemption was 35 million with a 45 percent tax above that amount. The TCJA changes expire after 2025.

Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. Most people focus on the federal estate tax but there are a bunch of states that levy an estate tax too with exemptions of various sizes. Second the federal estate tax exemption amount is still dropping on January 1 2026 from 11 million to 5 million adjusted for inflation.

The Economic Growth and Tax Relief Reconciliation Act of 2001. The official estate and gift tax exemption climbs to 1206 million per individual for 2022 deaths up from 117 million in 2021 according to new Internal Revenue Service inflation-adjusted. The Composition of Federal Revenue Has Changed Over Time.

Help us achieve our vision of a world where the tax code doesnt stand in the way of success. State estate taxes. Its now 117 million a person with a 40 percent tax above that amount.

How Does The Deduction For State And Local Taxes Work Tax Policy Center

/estate_taxes_who_pays_what_and_how_much-5bfc342146e0fb00265d85b5.jpg)

Estate Taxes Who Pays And How Much

Estate Tax Infographic Tax Liens And Deeds Authority Ted Thomas Http Www Tedthomas Com Estate Tax Author Tax

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Pin On Farm Succession Transistion

Philadelphia Estate And Tax Attorney Blog Irs Payment Plan Business Plan Template Free Irs

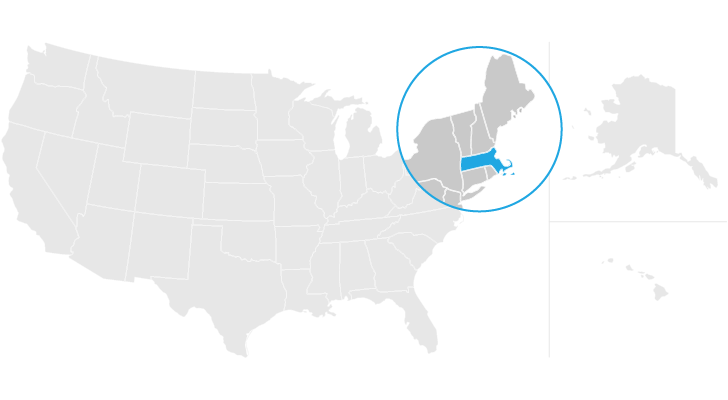

Massachusetts Estate Tax Everything You Need To Know Smartasset

Estate Planning Decoded Visual Ly Estate Planning Checklist Estate Planning Funeral Planning Checklist

New York Estate Tax Law Changes Are Paid For By Taxing Ings Nyc Newyorkcity Newyork Taxes Estate Tax New York Tax

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

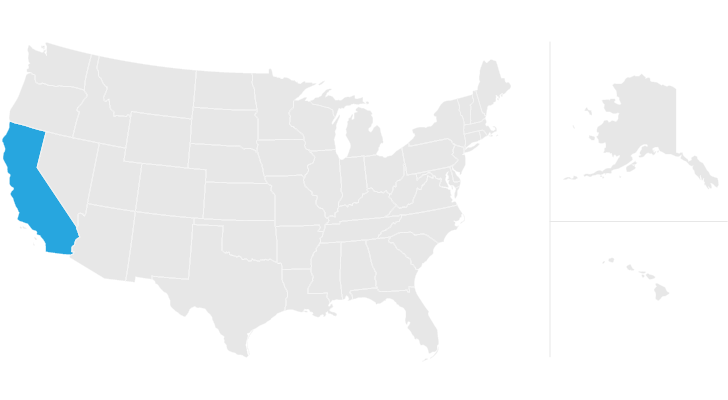

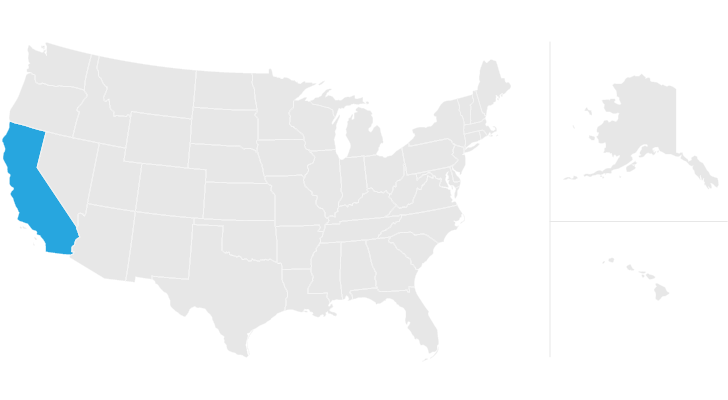

California Estate Tax Everything You Need To Know Smartasset

Taxday Estate Tax Income Tax Tax

Pin By Saklaw Ph On Pending Bills And New Laws Estate Tax Train Package Reform

The Tax Bill That Will Be In Force In The Up And Coming Tax Season Has Made Some Fairly Dramatic Changes To How Man Estate Tax Real Estate Tips Tax Deductions

California Estate Tax Everything You Need To Know Smartasset